Paul B Insurance Medigap Fundamentals Explained

Wiki Article

The Ultimate Guide To Paul B Insurance Medigap

Table of ContentsExcitement About Paul B Insurance MedigapHow Paul B Insurance Medigap can Save You Time, Stress, and Money.The 5-Second Trick For Paul B Insurance MedigapPaul B Insurance Medigap - TruthsNot known Details About Paul B Insurance Medigap Some Of Paul B Insurance Medigap

You've possibly noticed that Medicare is somewhat various from medical insurance prepares you've had previously. Prior to Medicare, your plan most likely consisted of medical and also prescription coverage. And also if you had medical insurance through work, you probably had oral and also vision insurance coverage, too. Original Medicare, or Medicare you get from the government, just covers clinical and also medical facility advantages.

The 9-Minute Rule for Paul B Insurance Medigap

Medicare health insurance plan offer Part A (Healthcare Facility Insurance) as well as Part B (Medical Insurance coverage) advantages to individuals with Medicare. These plans are normally supplied by private firms that agreement with Medicare. They include Medicare Advantage Program (Part C) , Medicare Price Plans , Presentations / Pilots, as well as Program of All-encompassing Treatment for the Elderly (SPEED) .1 As well as considering that you aren't all set to leave the labor force simply yet, you may have a brand-new alternative to take into consideration for your medical insurance coverage: Medicare. This article compares Medicare vs.

The 3-Minute Rule for Paul B Insurance Medigap

The difference between distinction in between personal and Insurance policy as well as that Medicare is mostly for individual Americans Private and older and also surpasses private exceeds exclusive health and wellness insurance policy number of coverage choicesInsurance coverage options private health exclusive wellness insurance policy permits protection.

If you select a Medicare mix, you can compare those sorts of plans to locate the most effective costs as well as protection for your requirements. Select a plan mix that matches your needs, and afterwards see thorough details concerning what each strategy will cover. Begin comparing plans currently. Initial Medicare Original Medicare (Parts An as well as B) offers medical facility and medical insurance.

Paul B Insurance Medigap for Beginners

Initial Medicare + Medicare Supplement This combination adds Medicare Supplement to the standard Medicare protection. Medicare Supplement strategies are created to cover the out-of-pocket costs left over from Initial Medicare.This can decrease the price of protected medications. Medicare Benefit (with prescription medication coverage consisted of) Medicare Benefit (Component C) strategies are sometimes called all-in-one strategies. In addition to Component An and Part B coverage, several Medicare Advantage strategies include prescription drug strategy insurance coverage. These plans also often include dental, vision, and also hearing coverage.

check this site out Medicare is the front-runner when it comes to networks. If you do not want to stick to view a minimal number of medical professionals or medical facilities, Initial Medicare is most likely your best option.

Paul B Insurance Medigap - An Overview

These areas and people compose a network. If you make a see outside of your network, unless it is an emergency, you will either have restricted or no protection from your medical insurance strategy. This can obtain pricey, especially since it isn't constantly easy for people to understand which carriers as well as locations are covered.

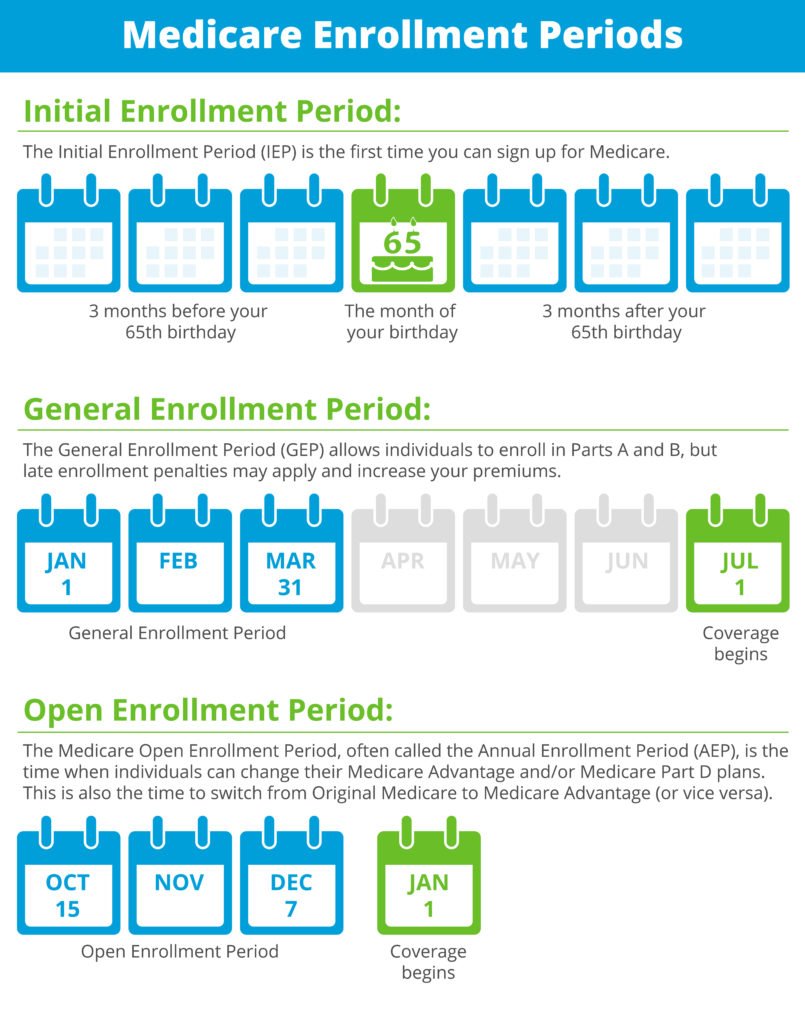

This is an area where your exclusive Affordable Treatment Act (ACA) or employer strategy may beat Medicare. The average regular monthly employer premium is $108. 2 While lots of people will pay $0 for Medicare Component A premiums, the standard premium for Medicare Component B is $170. 10 in 2022. 3 Components An as well as B (Original Medicare) are the fundamental foundation for coverage, and postponing your enrollment in either can cause financial fines.

These plans won't eliminate your Part B premiums, however they can offer extra protection at little to no charge. The price that Medicare pays compared to exclusive insurance policy depends on the services provided, as well as prices can vary. According to a 2020 KFF research study, exclusive insurance repayment rates were 1.

Paul B Insurance Medigap Things To Know Before You Get This

5 times higher than Medicare rates for inpatient medical facility solutions. Medicare has take advantage of to discuss with health care providers as a nationwide program, while exclusive health and wellness insurance prepares discuss as individual business.

You'll see these worked out rates reflected in lower copays and also coinsurance charges. You must additionally take into consideration deductibles when taking a look at Medicare vs. exclusive health and wellness insurance. The Medicare have a peek at this site Part An insurance deductible is $1,556. The Medicare Part B deductible is $233. 3 Usually, an employer insurance policy plan will have a yearly insurance deductible of $1,400.

It is best to use your plan information to make comparisons. On standard, a bronze-level health and wellness insurance strategy will certainly have a yearly clinical insurance deductible of $1,730.

Report this wiki page